Building wealth is probably the most spoken about topic across the world and will be for years to come. How to make money is the 24th most googled question in the world that’s 246,000 individuals per month hoping to find answers.

PIA 3 steps to wealth can help you answer these questions and  build a healthy wealth for your future. You can earn more and save for your future easily but many people get caught up in the old saying "You have to have money to make money." If you have this mind set you have already set yourself up for failure. The truth is you have to be driven, be willing to work hard now and invest so you see a return in capital.

build a healthy wealth for your future. You can earn more and save for your future easily but many people get caught up in the old saying "You have to have money to make money." If you have this mind set you have already set yourself up for failure. The truth is you have to be driven, be willing to work hard now and invest so you see a return in capital.

At PIA our model to success is to prosper through property. Property won’t make you wealthy overnight, but it is a great first step to financial freedom – a great form of income for you and your family in the future. The Sydney residential property market alone has increased by 74% since 2012[1]. Sydney offers promising returns for investors and the long-term outlook for this market is positive.

Follow our 3 simple steps to wealth and find out just how easy it can be to build your wealth.

1. Using the family home to build a property portfolio

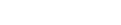

If you have equity in your own home, you’ve already taken the important first step on your property journey. That’s because the family home can be more than a great place to raise your children. It can be a powerful tool for growing your wealth and setting up your financial future.

After all, a lender may let you use the equity you already have in your home to fund the purchase of an investment property. That means you may not need any further deposit. Meanwhile, the rent your tenant pays should help you meet the cost of taking out your new loan.

2. Renting and buying simultaneously

Think you can’t afford to buy where you want to live but still want to get a foot on the property ladder? We’ll help you do both through our ‘Buy and Rent’ model. Under this strategy, which we pioneered back in 2005, our experts will help you select and manage a quality property with growth potential in an area and a development you can afford. Meanwhile, you can rent where you’d prefer to be based on your lifestyle, study or work. If you earn $70,000 you could buy an investment property worth $650,000 for as little as $42 a week, out of pocket[2].

3. Helping the children

Worried your children will never be able to afford property? We can show you how you can help them get their first foot on the property ladder. By using the equity in your own home, you may be able to get them into a property without the need to save a deposit. If they’re not ready to leave home just yet, we can even help you secure and manage a tenant who’ll help pay off your loan until they do.

It’s never to later or early to start thinking about the future and making a plan, invest in property to secure a comfortable, stress-free future for you and your family, build your property portfolio and build your wealth.

Call PIA sales consultant today to find out the right investment opportunities for you.

[1] Joye, Christopher, House prices in the long-term look positive despite rate hike, Financial review, 27/10/2017

[2] Net out of pocket expenses (assumes 100% lend and property is managed and tenanted for $500 per week)