It’s Saturday 9th March 2019 and 699 clients and 138 PIA sales staff attended a packed auditorium in Sydney Olympic Park for a Property Investment seminar. This is no ordinary seminar, this is the turning of sentiment. People have weathered the storm and are now charting their new course in the property market.

Waiting in the wings was Justin Wang, founder and MD of The Property Investors Alliance (PIA), reflecting on both the market and the large turnout. ‘

"That’s reassurance," he stated, "it’s been a tough 18 months for investors. Not only have they faced increasing challenges with restrictions on lending, LVR’s lowered and stamp duty increases – but they face a constant barrage of media negativity around the NSW growth engine – Property – undermining confidence. To see such a large turnout signifies 2 things to me: Savvy investors understand market cycles and confidence is being restored" said Justin

Savvy investors understand that property is a mid-long term investment and how to leverage property and market cycles to their advantage. Those new to investment on Saturday night were there to learn how to become a savvy investor. So what did they learn? …Now’s the time to buy.

Why now is the best time to buy property in Sydney:

- Buying now means entering the market, not just timing the market

Predicting the timing, absolute depth and duration, of any market cycle is near impossible…unless you have a crystal ball. We all want to buy low and sit back and count our equity. However, regardless of when you buy in the cycle, you’ve achieved the first key goal - at minimum you’ve entered the market.

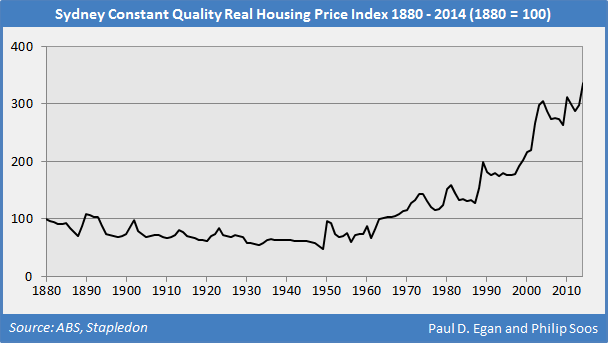

At PIA, we share our investment philosophy with our clients ‘Buy as early as possible, as many as possible, and hold onto for as long as possible’ – because the Sydney residential market only trends up over time.

Property prices are 18% higher than 5 years ago. If you bought 5 years ago, you’re in a stronger equity position today. Buying now will see you in a stronger position over the next 5 years than if you wait to try and ‘time the market’.

- Prices have adjusted

Whilst we haven’t seen anywhere near the scaremongering 40% drop from media predictions, we have seen housing values adjusted. But let’s put it into perspective - from the peak of the market in October 2017 to February 2019, we’ve seen a decline of just -6.8%[1]

Some areas have adjusted further than others, and there’s possibly some further adjustment to come, but don’t forget, this is Sydney. The market fundamentals here are strong and there is a strong history of growth.

Savvy investors are taking advantage of the price adjustments and are picking up some great value-for-money properties in NSW growth corridors with strong amenity and infrastructure investment as a result.

- The perfect storm… a coup for buyers

APRA policies and the Banking Royal Commission have seen an overall tightening in lending and LVR’s….fewer buyers in the market and negative media coverage affected sentiment…stronger supply in certain areas….overall housing prices adjust…have all served to impact buyer behaviour over the past 18 months.

However, fewer buyers, but with a strong equity position, and lower purchase prices means less competition, less reliance on bank finance (and LVR’s) and a stronger buying position.

PIA have thousands of properties, and savvy investors can do their research and find great value for money properties all across Sydney. With interest rates historically low, securing an investment property at a great value will provide you with a greater return in the long run, and a stronger equity position to leverage for your next investment!

- Sydney... always in demand

Continually topping the most desirable places to live, Sydney has proven itself, year after year, that it has long term sustainable benefits that support property investment and the economy - Infrastructure and Government investment, amenity, employment, world class attractions, and immigration, and so on.

But most compelling is its history of delivering, with property values doubling every 7-10 years.

- The proof is in the pudding

If we look at some key suburb areas that PIA has historically sold across, you can see that in just 4 years median sales prices have all increased[2]:

- Mascot +68%

- Botany +76%

- Parramatta +107% (doubled)

- Baulkham Hills +69%

- Epping +60%

- Lane Cove +85%

- Granville +51%

The time period above, 2014-2018, was prior to market peak and after market decline, demonstrating that Sydney property continues to trend upwards over time. You can’t argue with that!

If you'd like to register to attend our upcoming Propertry Investment Seminar (English), 6 April, reserve your place here http://bit.ly/PIAEngSeminar