How buy and rent (B&R) or rentvesting works

B&R or rentvesting is a strategy some savvy first home buyers use to get around Sydney’s affordability problem and onto the property ladder sooner. The strategy involves buying a property in a location you can afford and renting it out, while continuing to live in another area in a rental property.

That way, you can purchase your first property and have someone pay off your mortgage for you, while you keep your existing lifestyle in an area that you love.

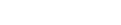

Doing the maths on rentvesting

One of the main advantages of rentvesting is often its cost-effectiveness. In fact, you may find that you have to pay very little each month towards the property, especially if you’re able to take advantage of the tax breaks associated with negative gearing.

That means you could be on the property ladder without needing to sacrifice much at all.

That means you could be on the property ladder without needing to sacrifice much at all.

Say, for instance, you purchase a property worth $650,000 and borrow 100% of the purchase price. Assuming you pay an interest rate of 4.5% and receive rental income of $500 a week, you could be just $43 a week out of pocket if your salary is $70,000.

Which properties are best suited to rentvesting?

For rentvesting to work to its full potential, it should generate a consistent cashflow. This means your property needs to be in demand with potential tenants so that the rent is high and vacancies are kept to a minimum. To achieve this, any property should be in an area that’s close to infrastructure and employment. It should also be well-presented.

Our experience is that newer properties with quality fittings and appliances often stand out from the crowd when it comes to attracting discerning tenants. A newer property can also have other benefits for you as an investor, including the ability to provide greater tax benefits due than an established property due to the potential for claiming depreciation.

Is rentvesting something you should consider?

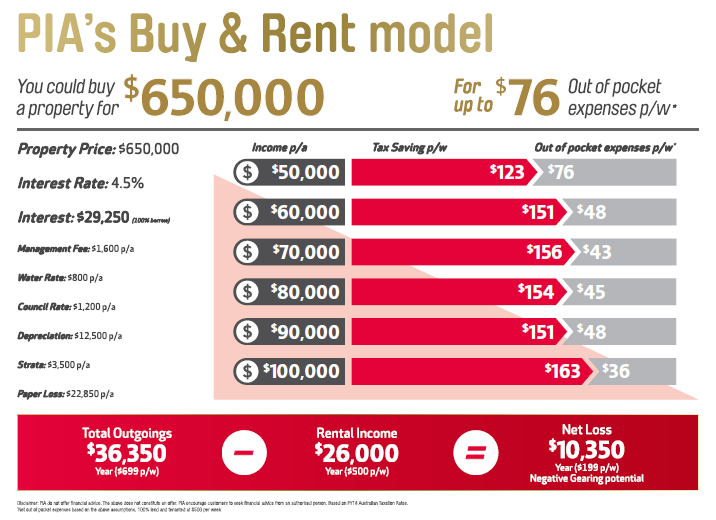

If you want to purchase your first Sydney property but you’re worried  about compromising your lifestyle, rentvesting could be an effective strategy. In fact, once you start building equity in your first property, you could use this to purchase a second and give yourself the foundation for creating an entire property portfolio that sets you on the path to real wealth.

about compromising your lifestyle, rentvesting could be an effective strategy. In fact, once you start building equity in your first property, you could use this to purchase a second and give yourself the foundation for creating an entire property portfolio that sets you on the path to real wealth.

That said, there are some things to consider. For instance, by buying a new property and living in it rather than renting it out, you may be entitled to the First Home Owner Grant as well as stamp duty concessions.

For this reason, you should always consult a financial adviser or other professional before committing to the strategy.

How PIA can help you get started with rentvesting

At PIA, we only offer properties in quality developments that have long term potential and will be in demand with renters. That way first home buyers will know their investment has the best chance of delivering a steady income as well as benefiting from capital growth.

To help provide certainty, we even offer the PIA Rental Guarantee[1] as standard on all of our off-plan and turnkey properties, plus a flat service fee for managing the property. This means you’ll know exactly what income you’ll receive each week, for the first three years, as well as your ongoing expenses, and can plan your finances accordingly. That’s an additional level of security for your investment.

If you’d like to know more about rentvesting through PIA, get in touch.

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs.

Sources/references

https://www.suncorp.com.au/about-us/news/media/what-is-rentvesting.html

https://www.pia.com.au/en/sydney-property-investment/

[1] PIA’s 3 year FWRG fixed rate applies to the majority of properties that PIA sells off-the-plan. The % rate differs by property type and location. Consult your PIA sales consultant or refer to PIA’s FWRG agreement for full terms and conditions.